The Benefits of Filing an Online Tax Return in Australia for Faster Processing and Refunds

The Benefits of Filing an Online Tax Return in Australia for Faster Processing and Refunds

Blog Article

Simplify Your Funds: Exactly How to Submit Your Online Tax Return in Australia

Declaring your online tax return in Australia need not be an overwhelming task if come close to methodically. Recognizing the complexities of the tax system and properly preparing your papers are essential very first steps. Picking a trustworthy online platform can improve the process, however several overlook important information that can impact their overall experience. This discussion will check out the required components and strategies for streamlining your finances, ultimately resulting in a much more effective declaring procedure. What are the usual pitfalls to avoid, and how can you guarantee that your return is certified and exact?

Understanding the Tax Obligation System

To browse the Australian tax obligation system properly, it is crucial to realize its basic principles and structure. The Australian tax system operates a self-assessment basis, meaning taxpayers are liable for properly reporting their earnings and calculating their tax obligations. The major tax obligation authority, the Australian Tax Office (ATO), looks after conformity and applies tax obligation legislations.

The tax obligation system consists of different elements, including revenue tax obligation, services and goods tax obligation (GST), and funding gains tax (CGT), amongst others. Private income tax is progressive, with prices boosting as income increases, while business tax obligation prices differ for huge and tiny companies. Additionally, tax offsets and reductions are offered to lower taxable income, enabling more customized tax obligations based upon individual conditions.

Understanding tax obligation residency is additionally essential, as it identifies a person's tax commitments. Locals are taxed on their around the world revenue, while non-residents are only tired on Australian-sourced income. Experience with these principles will encourage taxpayers to make informed decisions, making certain conformity and possibly maximizing their tax results as they prepare to submit their on-line income tax return.

Readying Your Documents

Gathering the needed documents is a vital action in preparing to file your on the internet income tax return in Australia. Appropriate documents not just improves the declaring process but likewise makes sure precision, lessening the risk of errors that could result in charges or hold-ups.

Begin by gathering your revenue declarations, such as your PAYG settlement summaries from employers, which detail your incomes and tax obligation kept. online tax return in Australia. Ensure you have your company earnings records and any relevant invoices if you are freelance. Furthermore, gather bank statements and documentation for any kind of interest made

Following, assemble records of deductible expenses. This might include receipts for job-related expenses, such as uniforms, travel, and tools, as well as any educational expenditures related to your career. Guarantee you have paperwork for rental earnings and associated expenditures like repair services or building monitoring charges. if you own building.

Don't neglect to consist of other relevant papers, such as your health and wellness insurance policy details, superannuation payments, and any financial investment income declarations. By carefully arranging these files, you set a solid structure for a smooth and effective on the internet tax obligation return process.

Choosing an Online System

After organizing your paperwork, the next action includes picking a proper online platform for submitting your income tax return. online tax return in Australia. In Australia, a number of credible platforms are offered, each offering special functions customized to different taxpayer requirements

When choosing an on the internet system, consider the interface and ease of navigation. An uncomplicated design can substantially boost your experience, making it much easier to input your information accurately. Furthermore, make certain the platform is compliant with the Australian Tax Workplace (ATO) policies, as this will assure that your entry meets all lawful requirements.

One more essential factor is the availability of client assistance. Systems using real-time chat, phone assistance, or detailed Frequently asked questions can provide important help if you run into obstacles throughout the filing process. Evaluate the safety procedures in location to secure your individual details. Seek systems that make use of security and have a strong personal privacy policy.

Lastly, consider the prices connected with various platforms. While some might use cost-free services for basic tax obligation returns, others might charge costs for innovative attributes or extra support. Weigh these variables to choose the system that straightens finest with your monetary situation and declaring requirements.

Step-by-Step Filing Process

The step-by-step declaring process for your online tax obligation return in Australia is developed to streamline the entry of your economic info while making certain compliance with ATO laws. Started by gathering all essential papers, including your income declarations, bank declarations, and any type of invoices for deductions.

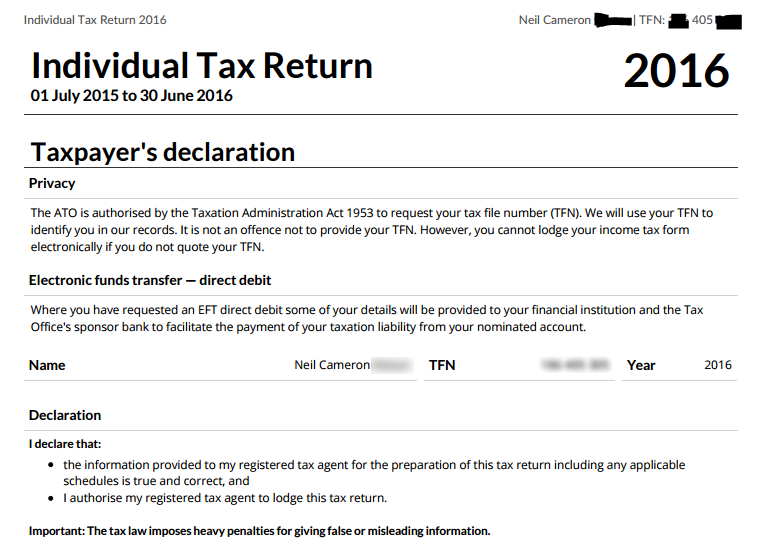

As soon as you have your files all set, log in to your his comment is here picked online platform and create or access your account. Input your individual details, including your Tax obligation File Number (TFN) and call information. Following, enter your earnings information precisely, making certain to include all incomes such as salaries, rental income, or investment revenues.

After detailing your revenue, go on to declare qualified deductions. This might include work-related costs, philanthropic donations, and medical expenditures. Make certain to evaluate the ATO standards to optimize your insurance claims.

As soon as all information is gone into, meticulously examine your return for precision, correcting any type of disparities. After ensuring everything is correct, submit your income tax return online. You will receive a confirmation of entry; maintain this for your records. Finally, monitor your account for any type of updates from the ATO regarding your income tax return standing.

Tips for a Smooth Experience

Finishing your on the internet income tax return can be an uncomplicated procedure with the right prep work and state of mind. To make sure a smooth experience, start by collecting all needed papers, such as your earnings statements, invoices for deductions, and any type of other relevant financial records. This organization conserves and lessens errors time during the filing process.

Following, familiarize yourself with the Australian Taxes Office (ATO) website and its on-line solutions. Utilize the ATO's sources, consisting of frequently asked questions and guides, to clarify any kind of uncertainties prior to you begin. online tax return in Australia. Think about setting up a MyGov account connected to the ATO for a streamlined declaring experience

In addition, benefit from the pre-fill performance supplied by the ATO, which immediately populates several of your info, reducing the chance of mistakes. Guarantee you double-check all entrances for accuracy before submission.

Lastly, allow yourself sufficient time to complete the return without feeling hurried. This will certainly help you preserve emphasis and decrease anxiousness. If complications emerge, don't wait to speak with a tax obligation professional or use the ATO's assistance services. Complying with these pointers can lead to a convenient and successful on the This Site internet income tax return experience.

Conclusion

In conclusion, filing an on the internet income tax return in Australia can be structured with cautious prep work and option of ideal resources. By recognizing the tax system, organizing necessary papers, and selecting a certified online system, individuals can navigate the filing process efficiently. Following a structured approach and utilizing available support makes certain precision and maximizes qualified deductions. Inevitably, these methods add to a much more effective tax filing experience, streamlining economic monitoring and improving compliance with tax obligations.

Report this page